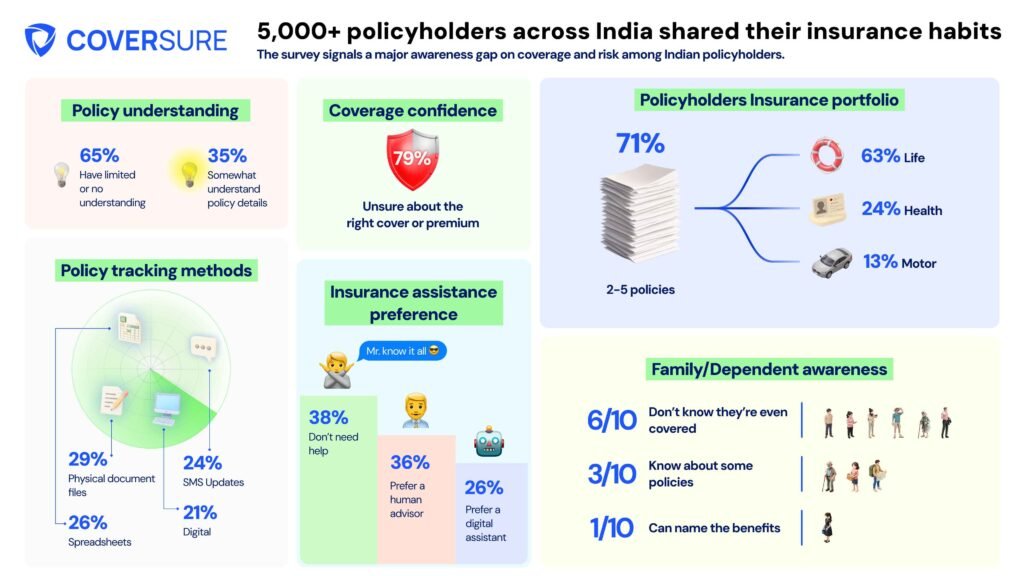

79% Indians Unsure About Adequate Insurance Coverage: A recent report by leading InsurTech firm CoverSure has revealed an alarming reality: a staggering 79% of Indian policyholders are uncertain if their insurance coverage is sufficient. Despite owning life, health, and motor insurance policies, most individuals remain unaware of what their plans actually cover. This points to a critical gap not just in financial literacy but also in the way insurance is sold and explained to consumers in India.

The survey polled over 5,000 respondents across metros and Tier II/III cities, aiming to understand awareness levels about policy benefits, exclusions, claims processes, and family coverage. The findings were deeply concerning—65% of respondents admitted to limited or no understanding of their policies, and nearly 60% of dependents were unaware they were even covered under any plan. These statistics underline the urgent need for insurance education at both individual and family levels.

The report also found that 71% of respondents held between two to five insurance policies, with life, health, and motor insurance being the most common. However, only 35% claimed they fully understood their insurance products. This vast disconnect between policy ownership and comprehension raises significant concerns about policy misuse, delayed claims, and financial insecurity during emergencies. The data serves as a clarion call to improve insurance literacy and simplify communication from insurers.

Who Can Apply for Insurance Policies in India?

Insurance in India is available to a broad spectrum of individuals. Here’s who is eligible to apply:

Eligibility Criteria:

- Age: Most policies are available to individuals aged 18 to 65 years. Certain plans like children’s plans or senior citizen health insurance have their own age restrictions.

- Indian Residents: Any individual with valid Indian citizenship or residency status is eligible.

- Non-Resident Indians (NRIs): Can also apply for certain insurance products.

- Health Requirements: Some policies may require medical tests or health declarations, especially for those above 45 or with pre-existing conditions.

- Income Proof: For policies like term insurance or investment-linked plans, proof of income may be required to determine the sum assured.

Insurance Fees and Premium Costs

Premium Variability:

Insurance premiums in India vary depending on:

- Type of policy (health, life, motor)

- Age of applicant

- Pre-existing conditions (for health policies)

- Coverage amount

- Add-on riders (like critical illness or accidental cover)

Also read: Drive Worry-Free This Monsoon Season: with SBI General’s Motor Insurance

Typical Premium Ranges:

| Insurance Type | Average Annual Premium (INR) |

|---|---|

| Term Life Insurance | ₹4,000 – ₹20,000 |

| Health Insurance (Individual) | ₹7,000 – ₹30,000 |

| Motor Insurance (Private Car) | ₹3,000 – ₹10,000 |

| Family Floater Health Plan | ₹15,000 – ₹60,000 |

Premiums can be paid monthly, quarterly, or annually, depending on the insurer’s policy.

How to Use Your Insurance Policy Effectively

1. Know What’s Covered

Understanding the inclusions and exclusions of your policy is critical. Each policy comes with a document called the “Policy Schedule” and “Terms and Conditions” that outlines:

- Coverage amount

- Benefits (hospitalization, death, theft, damage, etc.)

- Waiting periods

- Riders and add-ons

2. Track Your Policy Details

Always keep a soft copy and a printed copy of your insurance policy handy. Maintain:

- Policy number

- Date of purchase

- Premium payment schedule

- Emergency claim numbers

3. Claim Process

- Notify your insurer immediately during a claim event.

- Fill out the claim form and attach relevant documents like medical bills, police FIR, or hospital discharge summary.

- Submit online or offline depending on insurer process.

- Track your claim via the insurer’s mobile app or website.

4. Educate Your Family

Ensure that dependents and nominees are aware of the policy details. In case of emergencies, family members should know:

- What is covered

- Whom to contact

- Where to find documents

Benefits of Having Adequate Insurance Coverage

- Financial Protection: Protects your family or dependents against unexpected costs like hospitalization, vehicle accidents, or sudden death.

- Tax Savings: Under Section 80C and 80D, premiums paid on life and health insurance are eligible for tax deductions.

- Peace of Mind: Reduces anxiety during medical or accidental emergencies.

- Customisation: You can choose riders like critical illness cover, maternity benefits, or OPD consultations based on your needs.

- Easy Renewals & Claims: With the digital shift, many insurers offer cashless networks and online renewals, simplifying the overall experience.

How to Apply for Insurance in India

Steps to Apply:

- Research Policies: Use insurance aggregators or official insurer websites to compare plans.

- Check Eligibility: Confirm the age, income, and medical requirements.

- Get Quotes: Use online calculators to check estimated premium costs.

- Fill Out Application: Enter personal details, nominee information, and upload necessary documents.

- Medical Check-up (if required): Some policies mandate health checkups.

- Premium Payment: Make the first premium payment online or via bank.

- Receive Policy: The policy is issued digitally and/or by post.

Important Dates to Remember

| Event | Timeline |

|---|---|

| Annual Premium Renewal | Usually 12 months from policy start date |

| Free-Look Period | 15 days from policy receipt (can cancel with refund) |

| Claim Intimation Window | Within 24–72 hours (depending on policy) |

| Grace Period for Renewal | 15 to 30 days post expiry |

Disclaimer

This article is intended for general informational purposes only. The data and statistics are based on the CoverSure 2025 survey and publicly available information. Readers are advised to consult certified insurance advisors or official sources for policy-specific guidance. Insurance terms, premium rates, and eligibility criteria may vary across providers and are subject to regulatory changes.

79% Indians Unsure About Adequate Insurance Coverage Conclusion

India’s growing insurance penetration is a positive sign, but the lack of awareness about policy details threatens the very purpose of having insurance. While more Indians are purchasing insurance products than ever before, the knowledge gap is dangerous, potentially leaving policyholders and their families unprotected when it matters most.

This data from CoverSure is not just a survey but a call to action for policyholders, insurers, and regulators. Policyholders need to educate themselves and seek clarity from insurers before buying or renewing policies. Insurers, on the other hand, must ensure they simplify policy documents and improve customer onboarding processes.

It’s also vital to involve family members in financial planning, especially when they are the intended beneficiaries. Educating dependents about their rights and benefits will help avoid confusion and delays during emergencies.

Ultimately, insurance should be more than a checkbox. It should be a well-understood tool that offers true protection, peace of mind, and financial security in the face of life’s uncertainties.

79% Indians Unsure About Adequate Insurance Coverage FAQs

1. Why are so many Indians unsure about their insurance coverage?

Many Indians buy insurance as a tax-saving tool or because an agent recommended it, without fully understanding the product. Complex terms, lack of transparency from providers, and poor financial literacy contribute to this widespread confusion. The CoverSure survey shows that while ownership of insurance has increased, education about it has not kept pace.

2. How can I find out if my current policy offers adequate coverage?

Start by reviewing your policy document thoroughly. Look at the sum assured, benefits, exclusions, and claim process. If you’re unsure, contact your insurance company or consult a licensed advisor. You can also use online tools or mobile apps to compare your coverage with average benchmarks based on your age, health, and lifestyle.

3. What should I do if my family members don’t know about our insurance policies?

Create a centralized record (digital or printed) of all policies, including policy numbers, premium dates, and claim contacts. Share this with your spouse or a trusted family member. Educate them on what each policy covers and how to use it in emergencies. Some families even conduct an annual “insurance day” to review all documents together.

4. Can I increase the coverage of an existing policy?

Yes, many insurers allow you to top-up or upgrade your existing policy at the time of renewal or through riders. For example, you can add a critical illness rider to your term life policy or opt for a higher sum insured in your health insurance. However, increasing coverage may require a new medical evaluation.

5. Where can I compare different insurance policies easily?

You can compare policies using online insurance marketplaces like:

These platforms provide side-by-side comparisons of premiums, benefits, exclusions, and claim settlement ratios. Always ensure the site is IRDAI-licensed.