Banks & Insurance Mis-selling: In a significant move aimed at protecting Indian consumers from misleading financial practices, the Department of Financial Services (DFS) Secretary M Nagaraju has issued a stern warning to banks regarding the mis-selling of insurance products. Addressing an event announcing a strategic partnership between the Central Bank of India and Generali Group of Italy, Nagaraju emphasized the need for transparent insurance sales practices, fair premium pricing, and honoring claims without deviation. These steps, he noted, are essential not only for building public trust but also for boosting insurance penetration across India.

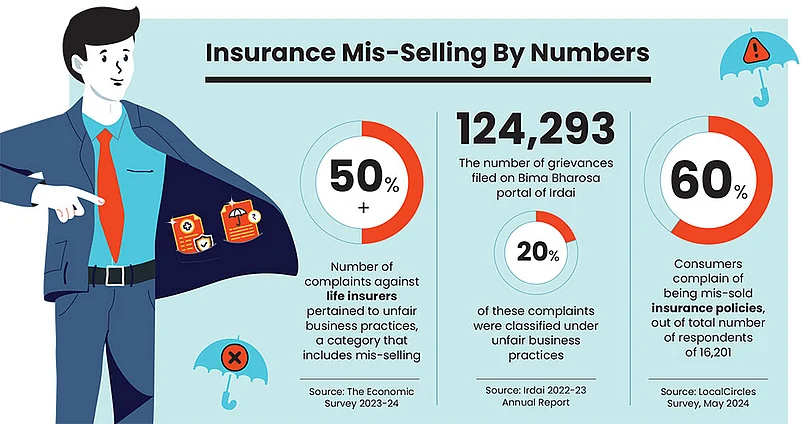

Nagaraju raised concerns over a troubling trend where customers are often explained one insurance product but sold an entirely different one—a tactic that leads to customer dissatisfaction and disillusionment with the financial ecosystem. This statement aligns with past alerts from Finance Minister Nirmala Sitharaman and IRDAI (Insurance Regulatory and Development Authority of India), both of whom have warned about the risks posed by bancassurance-related mis-selling. While the bancassurance model has helped expand insurance coverage geographically and demographically, it has also come under scrutiny for alleged misuse.

Further, Nagaraju highlighted that unaffordable premiums are a major deterrent for insurance buyers. High premiums not only discourage first-time policyholders but also result in lapses in policy renewals, thereby undermining the entire purpose of insurance. He stressed that insurance companies must offer affordable premiums and ensure that the terms and benefits promised in the policy are honored in full. Breaching this trust could result in a loss of credibility and long-term harm to the insurer’s sustainability.

Who Can Apply for Insurance Under the Bancassurance Model?

Anyone who holds an account with a bank participating in the bancassurance model can apply for insurance. These policies are typically available to:

- Individual savings account holders

- Fixed deposit customers

- Small business owners banking with the institution

- Pension and senior citizen account holders

- Loan customers (personal, auto, housing)

Special insurance products may also be offered to corporate clients and priority sector account holders, depending on the bank’s tie-ups with insurance partners.

Insurance Fees and Premium Structures

Understanding insurance fees and premium structures is crucial to making informed decisions. Here’s what to expect:

| Insurance Type | Typical Premium Range (₹) | Payment Frequency |

|---|---|---|

| Term Life Insurance | ₹2,000 – ₹25,000/year | Yearly, Half-Yearly, Monthly |

| Health Insurance | ₹3,000 – ₹30,000/year | Yearly or Monthly |

| ULIPs (Investment+Insurance) | ₹6,000 – ₹1,00,000/year | Yearly |

| Motor Insurance | ₹2,000 – ₹10,000/year | Yearly |

| Home Insurance | ₹1,000 – ₹6,000/year | One-time or Yearly |

Points to Remember:

- Always read the policy brochure to check fees and hidden charges.

- Ask for a Benefit Illustration Report.

- Choose premiums based on affordability, not on salesperson persuasion.

Also read: Consumer Panel Bars Loan Recovery from Widow: Finance Firm Penalised for Insurance Error

How to Use Insurance for Maximum Benefit

Insurance should be used strategically, not just purchased blindly. Here’s how you can get the most out of it:

- Know your policy terms – Understand the inclusions and exclusions.

- Maintain premium discipline – Missed payments can void benefits.

- File claims honestly and on time – Submit documentation within the claim window.

- Use cashless facilities – Especially in health insurance for hassle-free hospitalizations.

- Review and update nominees – Important in life and term insurance.

How to Apply for Insurance Through a Bank

Applying is straightforward and can be done both online and offline:

Offline Application:

- Visit your home branch.

- Speak to the bank’s insurance desk or relationship manager.

- Submit KYC documents (PAN, Aadhaar, Address Proof).

- Fill out the insurance proposal form.

- Pay the initial premium and receive a policy kit.

Online Application:

- Log in to your bank’s internet banking portal.

- Go to the insurance services tab.

- Choose from the available products.

- Upload KYC documents and complete e-verification.

- Pay digitally and download the e-policy document.

Important Dates and Timelines to Remember

| Event | Date/Deadline |

|---|---|

| DFS Secretary’s Warning Issued | June 27, 2025 |

| IRDAI Advisory to Banks | Ongoing from 2024 |

| Ideal Insurance Renewal Deadline | 15 Days Before Expiry |

| Free-Look Cancellation Window | Within 15 Days of Purchase |

| Policy Claim Processing Timeline | Within 30 Days (as per IRDAI) |

Disclaimer

This article is for informational purposes only and does not constitute legal, financial, or insurance advice. Customers are advised to consult directly with their bank or insurer before purchasing or renewing any policy. Always read the policy terms and conditions carefully. Rates and terms may vary based on age, health status, insurer underwriting policies, and regional regulations.

Banks & Insurance Mis-selling Conclusion

The recent warning from the DFS Secretary underlines the critical need to regulate bancassurance practices and ensure that banks act as transparent intermediaries rather than aggressive sales agents. While insurance is an important financial safeguard, its effectiveness is diminished when mis-sold to unsuspecting customers. Banks, as the first point of contact for many citizens, have a responsibility to act in good faith.

Insurance products, when sold with proper explanation, affordable premiums, and a clear claims process, can empower individuals and families financially. However, violations in selling ethics, such as selling products customers did not ask for, can destroy public trust in both banks and insurers.

The Finance Ministry and IRDAI are committed to protecting customer interests, and this should encourage more people to consider insurance seriously, knowing that regulatory oversight is in place. Going forward, the entire financial ecosystem must strive to be more customer-centric, ethical, and inclusive.

For policyholders and potential buyers, this is a timely reminder to be vigilant, ask questions, demand clarity, and most importantly—never sign anything you don’t fully understand.

Banks & Insurance Mis-selling FAQs

1. What is insurance mis-selling by banks?

Insurance mis-selling occurs when a bank sells an insurance policy without explaining its terms or sells a different product than what was discussed. This includes bundling insurance with loans without customer consent, or exaggerating returns and benefits to meet sales targets.

2. Can I cancel an insurance policy I bought from a bank?

Yes. Most insurance policies offer a “free-look period” of 15 days from the date of policy receipt. During this period, you can cancel the policy and receive a refund (subject to deductions like medical test fees or stamp duty).

3. How can I report a case of mis-selling by a bank or insurer?

You can:

- File a complaint on the IRDAI Grievance Portal

- Contact the Bank’s Grievance Redressal Cell

- Approach the Insurance Ombudsman via www.cioins.co.in

Be sure to attach policy documents, proof of mis-selling, and correspondence records.

4. What documents are required to buy insurance via a bank?

To apply, you typically need:

- PAN Card

- Aadhaar Card

- Passport-size photo

- Filled application form

- Income proof (for higher-value policies)

Some health and life policies may also require medical tests.

5. Are insurance premiums higher if I buy from a bank?

Not necessarily, but mis-sold or unsuitable products may result in you paying more than required. Always compare premium quotes across multiple insurers before finalizing a policy.