Global Health Care Policy: In today’s interconnected world, people travel across borders more than ever—be it for work, education, tourism, or medical needs. But while crossing international boundaries is easier, dealing with unexpected health emergencies abroad can be daunting and financially draining. This is where the Global Health Care Policy steps in—a comprehensive health insurance plan designed to offer coverage not just in India but globally. Whether it’s a planned treatment overseas or a sudden medical emergency in another country, this policy ensures you are financially protected.

The Global Health Care Policy is built for individuals and families who seek peace of mind while traveling or staying abroad. Traditional health insurance policies may not cover treatments outside India, which leaves a significant gap in protection. This globally inclusive health insurance plan bridges that gap effectively. It enables policyholders to access quality medical care without worrying about the heavy costs associated with international treatment, from hospitalization and surgeries to diagnostics and post-operative care. The policy also covers certain planned medical procedures, allowing users to travel for better or faster healthcare services abroad.

Whether you’re an international student, an NRI visiting India, a business traveler, or someone who simply wants extended health coverage across borders, this healthcare policy for global use is tailored for you. Alongside international care, the policy also offers comprehensive domestic coverage, ensuring round-the-clock protection no matter where you are. With easy claim processes, cashless hospitalization networks, and a wide range of coverage benefits, Global Health Care Policy brings the best of Indian and global healthcare to your fingertips.

Who Can Apply for Global Health Care Policy?

This insurance is designed for a wide range of individuals who require healthcare protection both within and outside India. The following individuals are eligible:

- Indian citizens residing in India

- Non-Resident Indians (NRIs) visiting or returning to India

- Overseas travelers with regular international trips

- Indian students pursuing education abroad

- Employees working on global assignments

- Senior citizens traveling for leisure or family visits

Age Eligibility:

- Entry age: 18 to 65 years for adults

- Dependent children: 91 days to 25 years

- No maximum exit age for renewal

Insurance Premiums and Fees

The premium for Global Health Care Policy varies depending on:

- Age of the insured

- Destination countries for coverage

- Sum insured (typically ₹50 Lakhs to ₹3 Crores)

- Type of plan selected (Individual/Family Floater)

- Duration of the policy (1 to 3 years)

Also read: SBI Life Celebrates Mothers

Sample Premium (Indicative):

| Age Group | Sum Insured | Duration | Estimated Premium (INR) |

|---|---|---|---|

| 18-30 | ₹50 Lakhs | 1 Year | ₹28,000 |

| 31-45 | ₹1 Crore | 1 Year | ₹36,000 |

| 46-60 | ₹2 Crores | 1 Year | ₹55,000 |

| 60+ | ₹2 Crores | 1 Year | ₹70,000 |

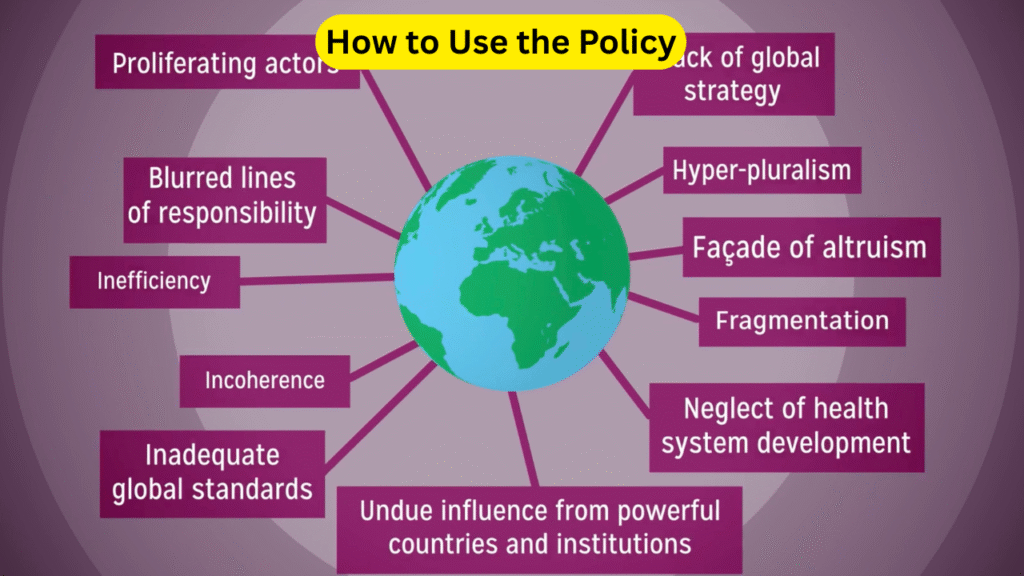

How to Use the Policy

Using the Global Health Care Policy is easy and efficient:

For Planned Treatments Abroad:

- Pre-authorization: Get approval from the insurer before traveling.

- Documents Needed: Medical diagnosis, treatment plan, estimated cost, passport, visa.

- Cashless Arrangement: Tie-ups with international hospitals allow cashless treatment.

- Reimbursement: If cashless isn’t available, you can apply for reimbursement with valid bills.

For Emergency Treatment Abroad:

- Contact Helpline: Use 24×7 global assistance numbers.

- Hospital Admission: Get admitted; insurer’s partners facilitate direct payment.

- Claim Filing: Submit documents within a specified timeline after discharge.

Benefits of Global Health Care Policy

- Global Coverage: Medical expenses covered in India and abroad

- Cashless Hospitalization: Network of hospitals worldwide

- Pre and Post-Hospitalization: Expenses covered up to 60 days before and 90 days after hospitalization

- Annual Health Check-ups: Included in selected plans

- Second Opinion Facility: Get expert medical opinions globally

- Mental Health & Maternity Cover: Available in premium variants

- No Claim Bonus: Up to 50% extra sum insured for no-claim years

How to Apply

Applying for the Global Health Care Policy is quick and seamless:

Online Application:

- Visit the official insurer’s website or health insurance aggregator.

- Fill in basic details (Name, Age, Destination, Duration).

- Choose coverage amount and plan.

- Upload documents (ID proof, medical history if required).

- Pay the premium online.

- Policy is issued digitally.

Offline Application:

- Visit nearest branch office or consult an authorized insurance agent.

- Submit filled form, documents, and pay via cheque/UPI.

Important Dates

- Policy Availability: Open year-round

- Pre-policy Medical Test: May be required for individuals above 45 years

- Claim Window: Within 15–30 days from treatment (reimbursement mode)

- Renewal Period: 15 days grace after expiry

Disclaimer

The details mentioned in this article are for informational purposes only. Actual policy terms, premiums, and benefits may vary depending on the insurer’s underwriting guidelines and government regulations. Always read the policy brochure and consult a licensed insurance advisor before purchasing. This content does not constitute financial advice. Insurance Ombudsman

Global Health Care Policy Conclusion

The Global Health Care Policy is more than just insurance—it’s a safeguard for your health across borders. With the increasing trend of medical travel and global mobility, having a policy that ensures uninterrupted healthcare access globally is crucial. Whether it’s a sudden emergency abroad or a pre-scheduled treatment, the policy covers all potential medical situations effectively.

From cashless hospitalization overseas to comprehensive diagnostics and post-treatment follow-ups, this policy takes care of everything. It’s also beneficial for Indian citizens who frequently travel or live abroad, offering them complete healthcare security.

Moreover, with rising medical costs worldwide, such insurance acts as a financial cushion, ensuring that you never compromise on healthcare due to budget constraints. It gives you access to top hospitals and specialists around the world, something traditional Indian policies don’t provide.

So, if you’re someone who values health and mobility, and want global peace of mind, investing in a Global Health Care Policy is a smart and secure choice. Make the move now and protect your future against any health uncertainties—anywhere in the world.

Global Health Care Policy FAQs

1. What is covered under the Global Health Care Policy?

The policy covers a wide range of medical treatments including hospitalization, diagnostics, emergency evacuation, daycare procedures, second opinions, maternity (in premium variants), and pre- and post-hospitalization both in India and abroad. It offers cashless and reimbursement claim options.

2. Is COVID-19 or pandemic-related treatment covered internationally?

Yes, many Global Health Care Policies now include pandemic and COVID-19-related treatments abroad, subject to terms and conditions. Travelers are advised to check specific coverage regarding quarantine, testing, and treatment for new variants.

3. Can I use this policy if I am studying or working overseas?

Absolutely. The policy is tailor-made for international students, expats, and corporate professionals working abroad. You must choose the right coverage duration and disclose your host country during the application.

4. Do I need to undergo a medical check-up before buying the policy?

Medical tests may be required if you’re above a certain age (typically 45) or have a medical history. For younger and healthy applicants, the policy may be issued based on self-declaration or telemedical consultations.

5. How is Global Health Care Policy different from travel insurance?

While travel insurance mainly covers trip-related issues like flight delays, lost luggage, and emergency hospitalization, Global Health Care Policy focuses solely on comprehensive medical coverage both in India and abroad—even for planned treatments. It has a wider scope and longer duration.